The SMARTER MORTGAGE Masterclass

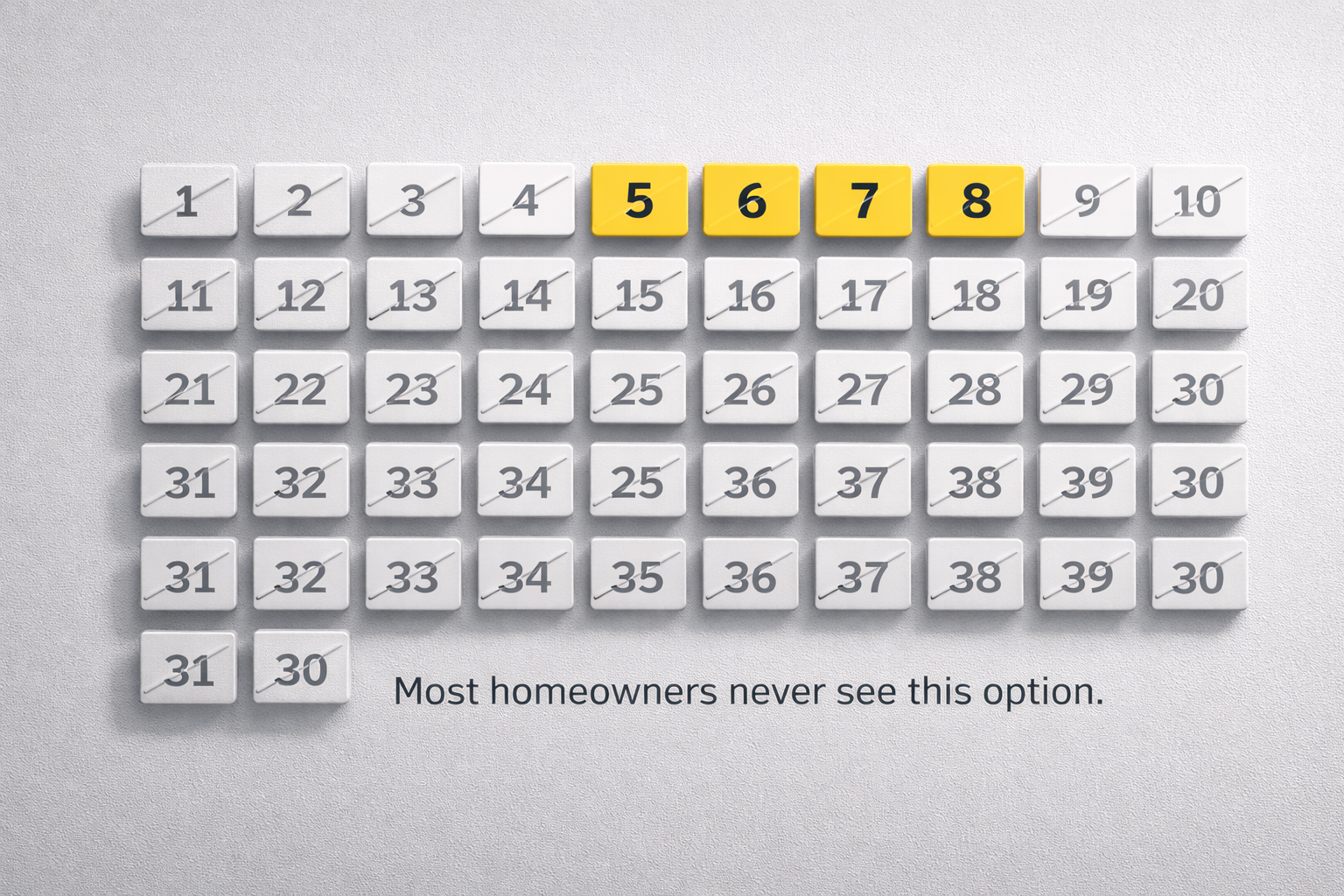

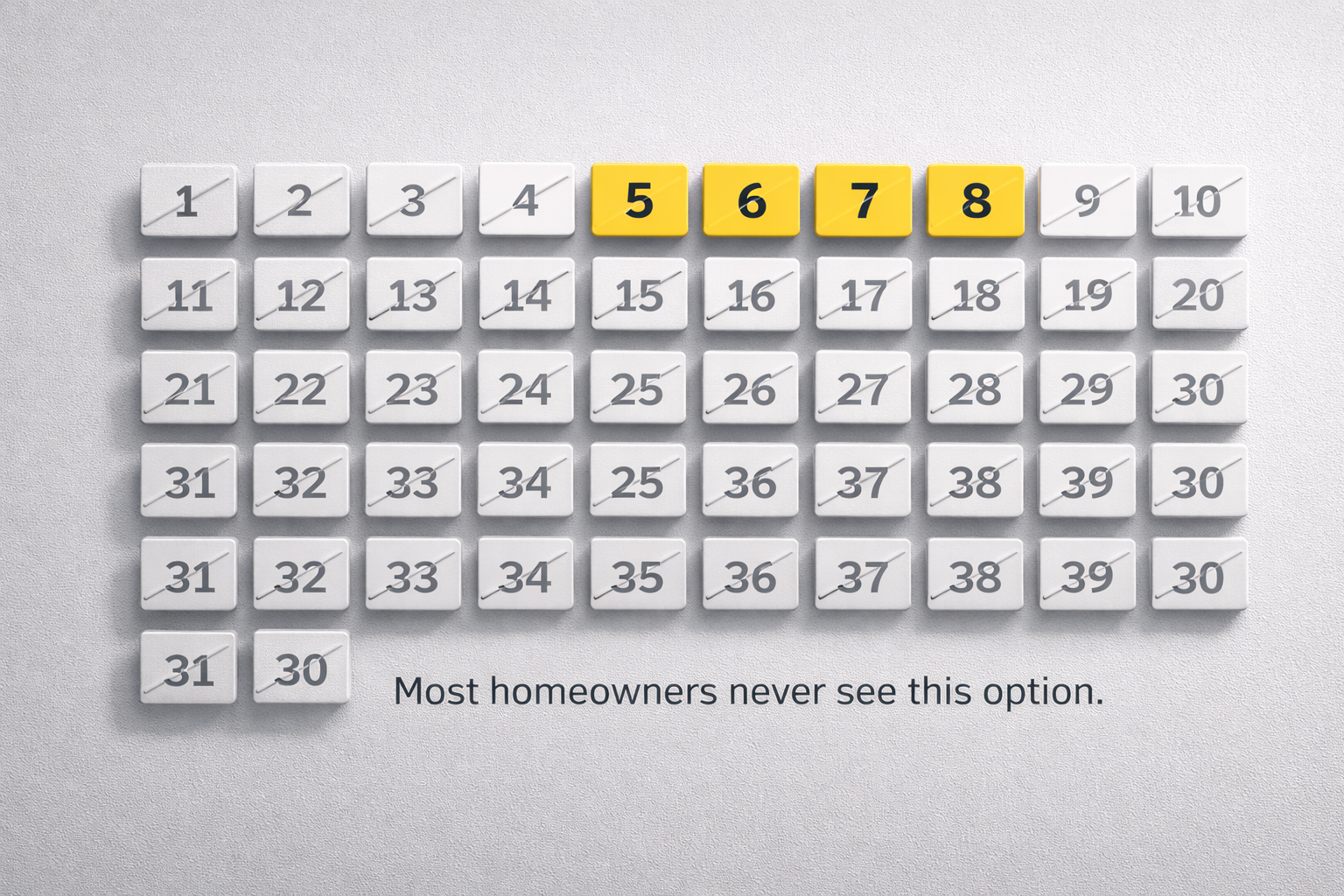

How Homeowners Pay Off Their Home in 5–8 Years—Without Risky Moves or Working More

If your equity is growing but your cashflow isn’t, this will completely change how you think about your mortgage.

FREE MASTERCLASS

Wednesday, Jan. 21st

12pm CST

ENTER YOUR IFNORMATION TO SAVE YOUR FREE SPOT

By submitting your information, you agree that we may collect and use your personal information for marketing, and for other purposes, as set forth in our privacy policy, which we encourage you to review.

What If Your Mortgage Isn’t Supposed to Take 30 Years?

You make good money.

You own a home.

You’ve been told to pay extra on your mortgage and stay disciplined.

Yet somehow…

You still feel stuck.

Most homeowners I talk to are house rich but cash poor.

Their equity keeps growing, but their day-to-day cashflow never improves.

The frustrating part?

It’s not because they’re bad with money.

It’s that most people don’t understand how mortgages actually work—or how some families quietly eliminate them in 5–8 years without drastic lifestyle changes.

What If Paying Extra on Your Mortgage Is the Wrong Move?

This might sound backwards, but it’s true. Paying extra toward your mortgage often doesn’t fix the real problem.

It can actually:

Reduce liquidity

Limit flexibility

Lock money away when you need it most

Your mortgage isn’t making you broke. Your strategy is. There’s a smarter way to use the mortgage you already have—one that can dramatically shorten the timeline to owning your home outright.

I Learned This the Hard Way

I followed the rules.

I made extra payments.

I did what every advisor said I should do.

And I still felt stuck.

Once I understood how the first lien actually works—and how liquidity changes everything—my entire approach shifted.

Using this strategy, I paid off a 27-year mortgage in just over three years.

More importantly, I regained control of my money.

Since then, I’ve helped 300+ families rethink their mortgage and take control without risky moves or gimmicks.

In this masterclass, you’ll learn:

Why paying extra on your mortgage doesn’t solve the real problem

How liquidity changes the way your money works

The biggest mistake homeowners make with equity

How the first lien actually impacts cashflow and control

A different way to think about your mortgage — without risky moves

How some families create flexibility without investing, flipping, or leveraging dangerously

This Is For You If…

You own a home and want it paid off years sooner

You’re tired of doing “everything right” and not seeing relief

You want a path to owning your home outright in 5–8 years

You want clarity, not complexity

You want options and flexibility — not just a smaller balance

If you own a home, this is worth understanding.

Why This Is Different

Most mortgage and financial advisors were never taught this.

This is homeowner education 99% of people never receive.

No pressure.

No risky tactics.

No “get rich quick” promises.

Just a clear way to understand how your money can work better for you.

Tyler Hennesse

Tyler Hennessee spent over 20 years in full-time ministry before realizing his calling extended beyond the walls of the church. His mission is simple: help people break free from systems that keep them stuck—financially, mentally, and spiritually.

After walking away from stability, Tyler built multiple successful businesses and earned a reputation for practical wisdom, integrity, and results. He doesn’t teach theory or hype—only clear, experience-based strategies that help people regain control of their money and time.

This isn’t about chasing wealth.

It’s about building a life that actually works—and lasts.